Aumont Capital funds Real Estate Development Projects with Aligned Equity & Debt Capital.

Aumont Capital is a boutique real estate financier that, on behalf of our multiple family office and institutional lending partners, specialises in structuring equity & debt project funding for property development and repositioning schemes.

We are delegated by our capital partners to source, underwrite, structure, and manage equity and debt investments in quality development projects.

To do so, we work with burgeoning and seasoned residential & commercial property developers to capitalise and deliver projects that feature sound fundamentals across commercial viability, quality of design, societal and environmental contribution, as well as sensible balance of risk and reward.

Uniquely, we invest Co-GP equity in selected projects to capitalise up to 100% of the development capital stack.

Aumont Capital Finances UK & International Real Estate Development Projects with Aligned Equity & Debt Capital.

Aumont Capital is a boutique real estate financier that, on behalf of our multiple family office and institutional investment partners, specialises in structuring equity & debt project funding for property UK and international development schemes.

We are delegated by our capital partners to source, underwrite, structure, and manage equity and debt investments in quality development projects.

To do so, we work with seasoned and burgeoning residential & commercial property developers to capitalise and deliver projects that feature sound fundamentals across commercial viability, quality of design, societal and environmental contribution, as well as sensible balance of risk and reward.

Project Funding Criteria

- Term: 1-5 years

- Equity: £5-100+ million

- Senior Debt: 90% LTC / 70% LTV

- Locations: UK, Europe, USA, Australia

- Property: Residential, hotel, commercial, co-living, PBSA, BTR, senior living.

DEVELOPERS

PROJECT FINANCE PARTNERS

For real estate developers, we seek to form relationships that stand the test of time; building multi-project capital partnerships that allow for long-term expansion of pipeline scale and volume, in a manner that gives capital surety, whilst enhancing development teams with complimentary resources.

As aligned and entrepreneurial financiers, we work with you to best prepare your project for success, proceeding to fund your project using the most efficient capital structure possible.

Utilising the discretionary investment capability afforded by our family office investors, we can underwrite projects quickly, provide timely proof of funds to demonstrate financial capability to transactional parties, and proceed to structure an equity and debt capital stack that best suits your project.

And although we are discerning to invest in only quality projects and capable sponsors, we welcome the opportunity to back seasoned and new developers alike.

INVESTORS

CAPITAL ALLOCATION PARTNERS

For family office & HNW investors, as well as international banks, asset & fund managers, Aumont act as a unique extension to your origination & execution teams by sourcing, evaluating, and structuring high quality senior debt, mezzanine, and preferred equity real estate investment opportunities across the opportunistic and value-add spectrum of the real estate asset class.

By leveraging Aumont Capital as your real estate development debt and equity investment origination, structuring, and management partner, your in-house infrastructure is augmented with over two decades of international real estate investment management and development management experience via one aligned partnership.

Whether your allocation mandate is a combined debt and equity strategy, or a highly targeted debt-only or equity-only strategy, we will work with you to understand your requirements and source, qualify, and originate real estate development and repositioning investment opportunities that meet your criteria.

Real Estate Development Capital for Acquisition, Construction & Stabilisation.

Equity Investment

On behalf of our multiple family office investment partners, we structure equity investments into well-conceived projects under terms that are favourable for our development partners to maximise project profit share.

Selectively, we can also invest Co-GP equity via our JV partnership model to capitalise up to 100% of the project capital structure.

Senior Debt

Utilising our established panel of institutional bank and credit fund lenders, we install senior and stretched-senior secured debt facilities for real estate projects across the development lifecycle; including, pre-construction (site acquisition), construction, and post-construction (equity release & stabilisation) finance facilities.

Mezzanine Loans

For development projects requiring a mezzanine tranche to complete and/or optimise their capital stack, we utilise our panel of opportunistic credit funds, family office and selected HNW investors to infill the capital between senior debt finance and equity investment.

Bridging & Special Situations

We understand the intensive and timely capital demands of real estate development; and as such, we are adept at providing short-term, bridging, transitional and special situation finance for purposes of site acquisition, pre-completion equity release, and pre-stabilisation construction facility refinancing.

Kings Cross, London

Project: 121 Apartments + 30,000 sf Office.

Capital: Senior debt + Pref. Equity

Debt: £72M / Equity: £22M

Project Value: £115M

Crown Towers, London

Project: Mixed Office, Residential & Hotel.

Capital: Pref. Equity

Equity: £65M

Project GDV: £518M

Hanwell, London

Project: 43 Residences + 5,600sq Retail.

Capital: Senior debt

Debt: £15M

Project GDV: £25M

Exeter, UK

Project: 160 Key Hotel & Amenities.

Capital: Senior debt

Debt: £16M

Project GDV: £28M

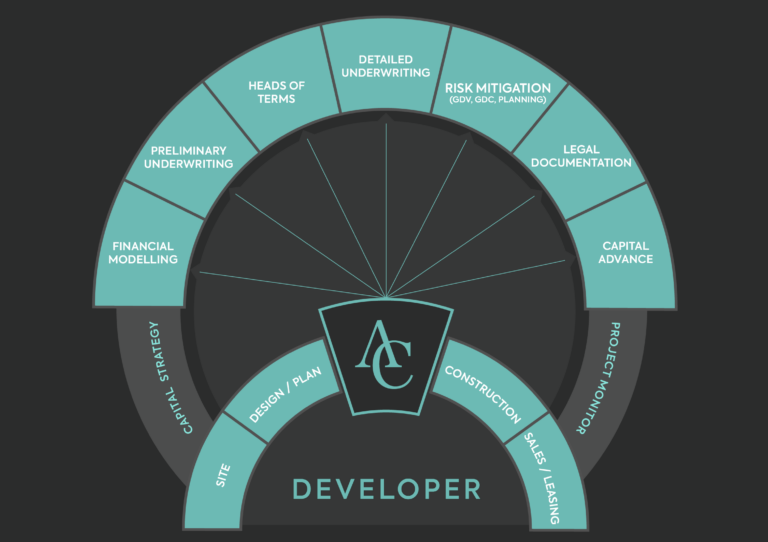

Integrated Development Capital Model

Aumont Capital can provide whole-capital-stack debt and equity structures that efficiently capitalise real estate development projects to optimise sponsor equity contribution, cost of capital, and investment IRRs. Combining discretionary equity funds with preferential debt facilities, we work collaboratively with our development, investment, and lending partners to form capital structures that align the interests of all stakeholders.

About Us

Aumont Capital was founded by Ryan McWaters who, for over two decades, has enjoyed an encompassing international career in property development, PERE asset management, and real estate investment banking.

In forming Aumont Capital Ryan extends the breadth of his extensive experience for the benefit of each our respective project and capital partners.

Utilising this comprehensive experience and deep understanding across the real estate development life cycles, as well as the various compositions of capital structures that can be applied to small, medium and large-scale projects, Aumont Capital converges the interests of our investment and development partners with aligned balance.

Please contact us to discuss how we can support your project funding or capital allocation requirements.